Will the Serviced Apartment Boom last in 2023?

TL;DR—Just maybe, if they stick to their guns.

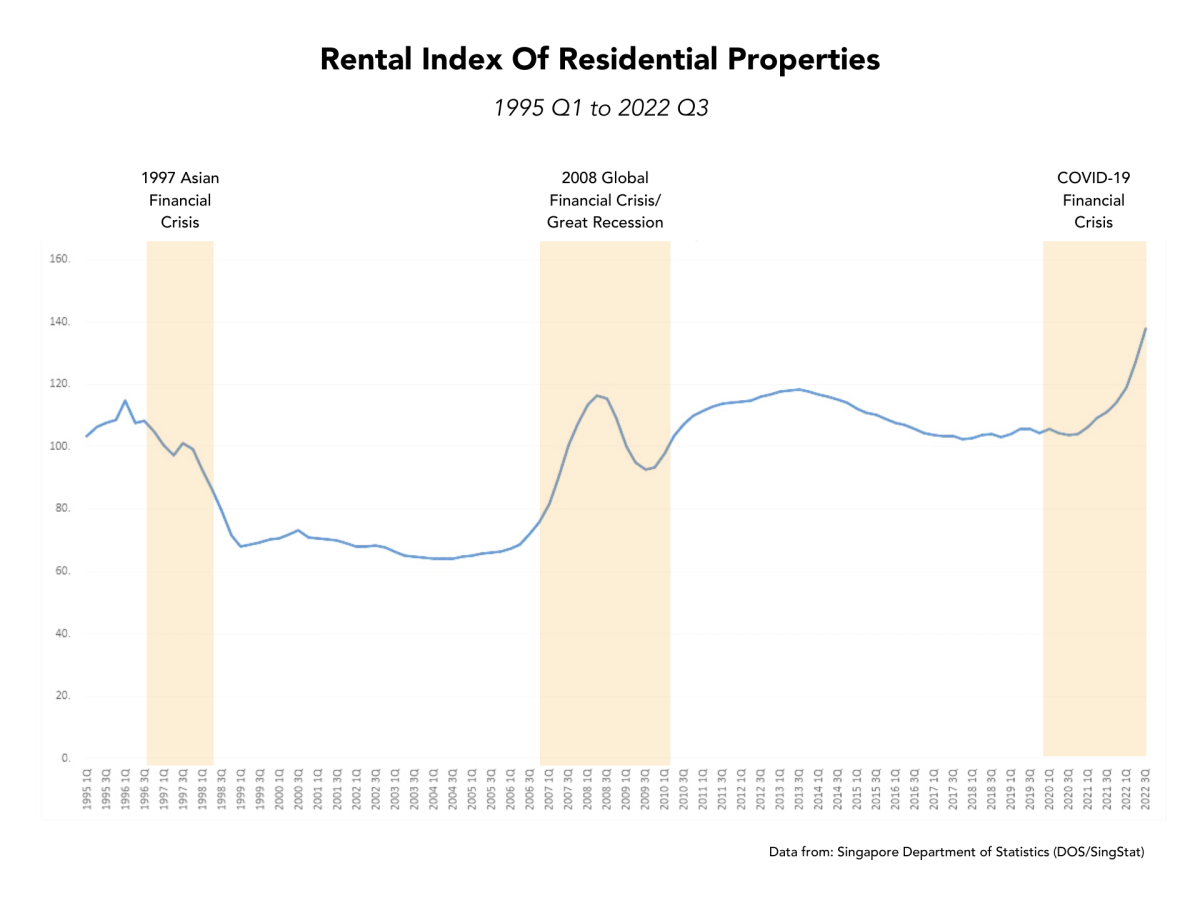

What. a. year. According to Savills, private residential rents were at the highest since the start of the Urban Redevelopment Authority’s time series in 4Q1998. Yet Singapore’s serviced apartment market persevered. Right at the top of the year, ST Residences opened a 20-unit rental development in Balestier. Ascott acquired Oakwood in July 2022. Coliwoo and The Assembly Place are still expanding. But will the serviced apartments boom last through 2023? Here’s our take.

The World in 2023

In the big picture, things look to be shaken up. China has only recently eased its COVID-19 restrictions. But the transition looks to be rocky as there is an incoming surge of new infections. Not to mention, vaccinations among older people in China have remained even post-pandemic.

Meanwhile, Europe and North America will face a recession in early 2023 because of reduced consumer spending as high inflation persists. Those economies will also experience the impact of softening demand and tightening financial conditions on housing markets and capital investment. These conditions will likely affect global trade and capital flows as these economies account for over half of the world’s output.

But the picture in the Asia Pacific might look a bit better. The region is well-positioned for growth with the help of efficient supply chains, regional free-trade agreements, and competitive costs. India, Indonesia, and the Philippines will lift growth as those regions experience strong consumption levels in their more domestically-led economies. However, export-led economies, such as South Korea and Taiwan, might experience softer growth in the face of weaker demand in the global economy.

Singapore in 2023

The nation-state might be a bright spot in all the gloom. Singapore has received capital investments that would have been directed to Japan, Hong Kong and China. In addition, real estate investments in Singapore buoyed its economy, where investment volumes soared by 47% YOY to US$9.1 billion.

Even so, inflation might roil this rosy outlook. Some local developers are feeling the burn from rising material and manpower costs. One even noted a 15% increase.

Nevertheless, Singapore’s growth will still have to face global headwinds too. The Federal Reserve’s monetary tightening is stoking fears of a recession in most global economies. Also, the true cost of the war in Ukraine may yet be fully realised by next year.

The Cooldown Begins

What will happen to the rental market in Singapore in 2023? It’s anybody’s guess. There are a wide variety of factors that can affect rent and value, so we can only work with correlations and our assumptions.

Historically, rental rates dipped with the onslaught of a recession. But COVID-19 created a unique set of circumstances. Delayed construction has led to supply constraints in Singapore. Meanwhile, demand for long-term rentals for Singapore’s serviced apartments and apartment rentals has increased as the nation brushes off pandemic restrictions. Buoyed by demand from both local and global tenants, the market saw skyrocketing prices that made headline after headline.

But with turbulent geopolitics and a global economic slowdown, global businesses in Singapore may be tightening their purse strings. The softening of Singapore’s growth could exacerbate that as well. The United Overseas Bank (UOB) Group expects the gross domestic product (GDP) growth to slow to 0.7% in 2023, as key end markets in Singapore enter a recession. Manufacturing and external-oriented services, such as wholesale trade, transport, and finance, will face a hit to their growth levels.

What to Expect in 2023

Short-term rentals and the hospitality sector can expect sustained occupancy levels. The recovery of the leisure and business air travel sectors will continue to fill up hotel rooms in Singapore. JLL, the global commercial real estate services company, expects the hospitality market to experience a 6% year-on-year increase in investments for 2023, extending its 10-15% year-on-year increase this year.

But in light of a negative outlook on growth, rental rates could plateau and taper off. Business travellers coming into Singapore may cut short their stays or take their overseas work online. Moreover, the tech sector has seen layoffs after layoffs from both global players and local upstarts.

Long-term apartment rentals in Singapore will bear the brunt of this. The serviced apartment business has been buoyed by local demand for most of 2022, which is historically rare. More people have been looking for temporary accommodation as they wait for the completion of new homes.

The new year will bring in more supply of residential homes as well. A total of 38 residential projects are due for completion, adding 16,000 new units to the market. So those staying in Singapore condos and apartment rentals can be cautiously hopeful of some relief before the end of next year.

The Big Pivot for Serviced Apartments?

How will serviced apartments thrive in the new year? Online meetings have yet to replace on-site ones. Travel will continue to be a cost of doing business. But as corporations reduce travel frequency, corporate stays might have longer durations next year. Business travellers might extend these trips with their annual leave for a little vacation before they return.

What’s more, with short-term rentals being well-regulated, long-stay serviced apartments in Singapore are well-positioned to experience another robust year. Serviced apartments usually offer better compliance, security and structure; coveted features for most corporations.

They’re often located in convenient locations, offering easy access to amenities for families and digital nomads alike. Moreover, serviced apartments offer extra creature comforts in the form of fully-furnished interiors, wi-fi, and fully-equipped kitchens. It doesn’t take much to convert these apartment rentals in Singapore to smart homes either.

To sustain accommodation rates, serviced apartment providers may need to shift more of their focus to ensuring customer loyalty in the form of extra perks or services. Ascott leads the pack with this, upgrading its signature Ascott Star Rewards to include more exclusive benefits such as priority check-ins, birthday discounts, unique welcome amenities and signature gifts.

Industry players may expect a little more windfall before new homes enter the market. But a holistic approach towards enhancing customer stays will go a long way in securing business in uncertain times.

Top-Notch Singapore Serviced Apartments at MetroResidences

As we take another step into the era of uncertainty, a sense of familiarity and stability takes centre stage in our living spaces and working spaces. Looking for your home away from home? Our Singapore apartment rentals and serviced apartments are perfect for a longer period of stay. We have properties in luxury developments across Singapore’s most coveted addresses: Bugis, Bukit Timah, Shenton Way, and Novena.

All of our apartments adhere to our strict Property Standards that account for the comfort and cleanliness of all our listed serviced apartments. Our fully-furnished apartments come with amenities like wi-fi, air conditioners, and a fully-equipped kitchen.